What is a Charitable Gift Annuity?

(From the American Council on Gift Annuities) A charitable gift annuity (CGA) is a contract (not a “trust”), under which a charity, in return for a transfer of cash, marketable securities, or other assets, agrees to pay a fixed amount of money to one or two individuals, for their lifetime.

A person who receives payments is called an “annuitant” or “beneficiary”. The payments are fixed and unchanged for the term of the contract. A portion of the payments are considered to be a partial tax-free return of the donor’s gift, which are spread in equal payments over the life expectancy of the annuitant(s).

The contributed property (the gift), given irrevocably, becomes a part of the charity’s assets, and the payments are a general obligation of the charity. The annuity is backed by the charity’s entire assets, not just by the property contributed. Annuity payments continue for the life/lives of the annuitant(s) no matter what the investment experience of the gift annuity fund.

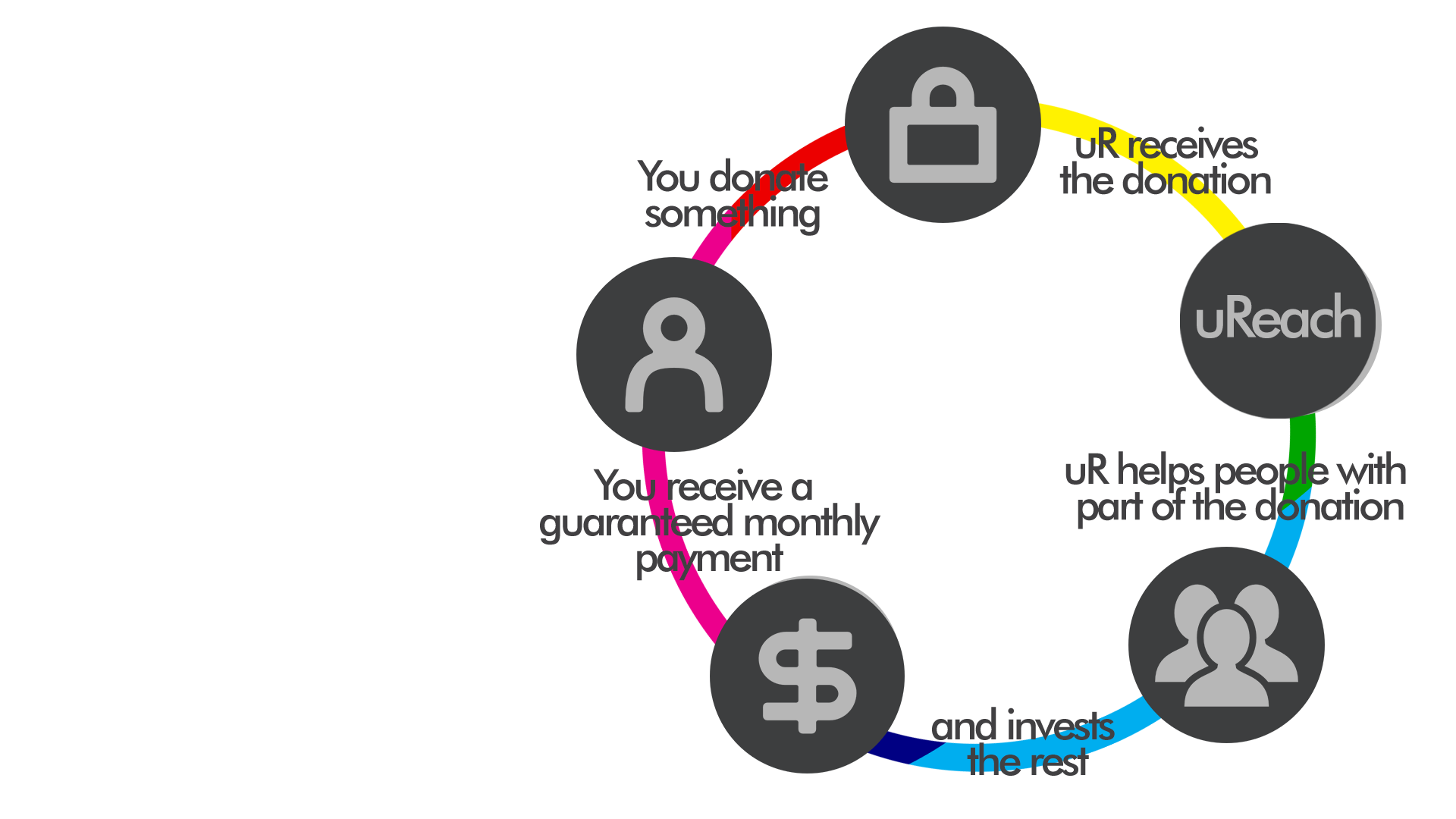

How does this really work?

- You contact us and we get the information about what you want to give.

- We get our experts involved who can help us set everything up in accordance with the law and standard practices.

- You start getting paid and we help students with your donation.

What is the best kind of CGA?

Because of various tax laws, we think donating anything that has capital gains (like stock funds and real estate) associated with it really makes sense for the donor. Income property especially makes sense and here’s how it plays out:

- You buy a rental property for $100,000

- 10 years later, the property is worth $300,000

- When the property is donated as a CGA, the taxes (37% estimated in California, for instance) are not owed by the donor and although the rate of return might be lower, the rate would be based on a $200,000 investment instead of the $126,000 after tax investment, possibly resulting in a higher return.

- The donor usually receives a partial tax deduction for the year of the donation.

Feel free to contact us using the contact form on this page, or just call us at (916) 304-3356 if you have any questions. We’ll do our best to get you the information you need as quickly as possible.

*Please note, StudentReach is not a tax expert and the information here is included to be a brief explanation of general guidelines. Please consult IRS.gov and your own tax professional for legal or tax advice.